KRA partners with KICD to integrate tax education into schools under CBC

The partnership will see the integration of tax education into key subjects such as business studies, Mathematics, English, Kiswahili, and social studies under the competency-based curriculum (CBC).

The Kenya Revenue Authority has partnered with the Kenya Institute of Curriculum Development to enhance tax literacy among learners in the country.

The partnership will see the integration of tax education into key subjects such as business studies, Mathematics, English, Kiswahili, and social studies under the competency-based curriculum (CBC).

More To Read

- Weak taxation of wealthy costs Kenya Sh130 billion annually, report finds

- Government raises primary school capitation by 58 per cent to Sh2,238 per learner

- Ex-Nairobi governor Sonko gets relief as Tribunal directs KRA to unfreeze his bank accounts

- Education Ministry pledges early capitation release for smooth start to new term

- Businesses granted 30-day relief on long-stay container charges at Mombasa port

- Meta to deduct 5 per cent tax on Kenyan creators’ earnings in 2026

Through the use of technology, KRA will develop specialised digital resources that will simplify tax concepts and integrate tax education into mainstream learning.

Commissioner-General Humphrey Wattanga, during discussions with KICD leadership on Tuesday, stressed the importance of introducing tax education early in the lives of learners.

“By integrating tax education into the curriculum, we empower the next generation to make informed financial decisions and contribute meaningfully to our nation's development,” he said.

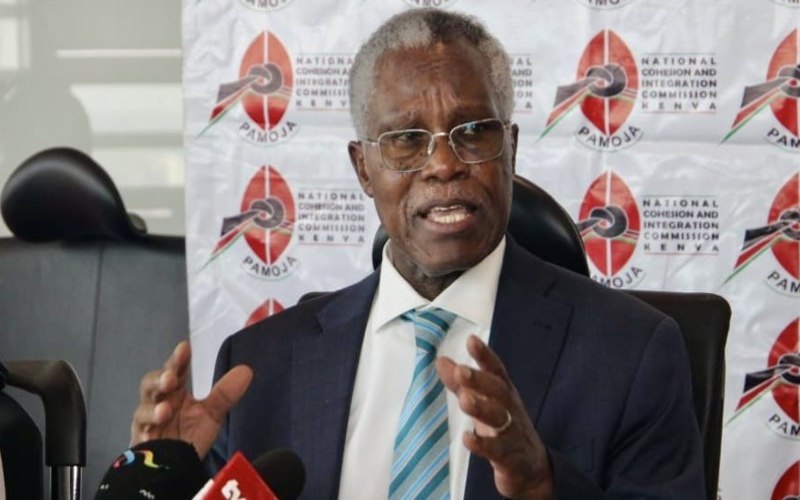

Kenya Revenue Authority Commissioner-General Humphrey Wattanga. (Photo: KRA)

Kenya Revenue Authority Commissioner-General Humphrey Wattanga. (Photo: KRA)

He further expressed his optimism that this initiative will foster a sense of responsibility towards the tax system, which will ultimately lead to higher tax compliance rates.

Tax education isn't just about numbers. It's about fostering a culture of responsibility, transparency, and civic engagement. By instilling these values early on, we sow the seeds for a brighter and more prosperous future for all,” Wattanga emphasised.

The collaboration, extending from primary to tertiary education, seeks to target potential taxpayers from a young age. Dr Samuel Obudho, Senior Deputy Director of TVET, hailed the partnership's efficiency in reaching a wide audience.

"This partnership provides an efficient platform for KRA to reach a wide audience," Dr Obudho stated.

KRA said that the e-content developed through the partnership will target learners in junior and senior high schools, upper primary education, primary teacher trainees, secondary teacher education trainees, teacher trainees in early years education, learners in early years education, and the general public.

"Through accessible and innovative digital resources, the aim is to empower students and the broader public with the knowledge and skills to navigate the tax landscape effectively," KRA said.

Top Stories Today